What to see in Europe today

Economic Data: The Bank of England publishes a survey of credit conditions, while the UK’s Office for Budget Responsibility publishes its annual Financial Risks and Sustainability Report. France releases inflation data. The European Central Bank publishes accounts of its June meeting’s monetary policy discussions.

Oil: Monthly oil market reports are expected from the International Energy Agency and OPEC.

NHS: NHS England publishes closely watched statistics, including A&E waiting times, in May and June.

Meetings: Japanese Prime Minister Fumio Kishida attends the EU-Japan summit starting in Brussels, while US President Joe Biden joins a summit for Nordic leaders in Helsinki.

Results: Revenue comes from Norwegian oil exploration company Agar BP and UK’s largest luxury timepiece retailer Watches of Switzerland.

Oil prices have risen as China’s fuel imports rise and US inflation slows

Oil prices rose on Thursday as new data showed Chinese imports of the fuel rising and traders reacted to softening inflation in the United States.

Brent crude, the international benchmark, and U.S. marker West Texas Intermediate both added 0.4 percent to trade at $80.44 and $76.02 a barrel, respectively.

China’s June trade data released on Thursday showed crude oil imports rose to 52.1 million metric tons, up 40 percent from a year earlier and up 4.6 percent from the previous month. China is an important market for fossil fuels.

Crude oil was boosted by softer-than-expected inflation data from the United States on Wednesday, which showed consumer prices added 3 percent and moderated more than economists expected.

Chinese trade falls in June as global demand slows

China’s exports and imports both contracted faster than expected in June, adding to mounting trade pressures on the world’s second-largest economy.

Exports fell 12.4 percent year-on-year in dollar terms, official data showed, while imports fell 6.8 percent. Exports and imports fell by 7.5 percent and 4.5 percent respectively in May.

China’s exports surged during the pandemic, but face weaker international demand this year as global interest rates rise.

Trade interventions have come with a tepid economic recovery since the country’s lifting of Covid-19 restrictions earlier this year and continued weakness in the property sector, prompting calls for further stimulus.

Asian markets rose after the US reported weak consumer price data for June

Positive moves in Asia tracked gains in US markets © Bloomberg

Asian markets rose on Thursday following weaker-than-expected June consumer price index data from the US, easing pressure on the Federal Reserve for an interest rate hike.

China’s CSI 300 and South Korea’s Kospi were up 0.7 percent each, while Japan’s TOPICS rose 0.8 percent and Hong Kong’s Hang Seng index added 2.1 percent.

Beijing on Wednesday pledged to support tech platforms, signaling an end to its crackdown on the sector.

The moves followed a rally in U.S. markets, with the S&P 500 up 0.7 percent on Wednesday. US core CPI came in at 4.8 percent, below the 5.0 percent forecast by economists polled by Reuters.

What to see in Asia today

South Korea: Economists expect the Bank of Korea to keep rates at 3.5 percent for the fourth meeting.

Meetings: The EU-Japan summit begins in Brussels, attended by European Council President Charles Michel, European Commission President Ursula van der Leyen and Japanese Prime Minister Fumio Kishida.

Supporters of Pita Limjaronrat’s Move Forward party raise the three-finger salute, a symbol of protest, during a protest in Bangkok on Wednesday © AP

Thailand: The vote for the new Prime Minister will be held in Parliament. Pita Limjaronrath, whose progressive Move Forward party won a landslide victory in May’s general election, still faces obstacles to replacing the military-backed government, including questions about violations of election rules.

Markets: Futures rose in Hong Kong on Thursday morning. U.S. stocks and Treasuries rallied on Wednesday, while the dollar fell after inflation fell more than expected in June, easing pressure on the Federal Reserve to raise interest rates. The S&P 500 ended up 0.7 percent, while the Nasdaq composite gained 1.2 percent.

Disney extends CEO Bob Iger’s contract through 2026

Disney has extended its chief executive Bob Iger’s contract until the end of 2026, a short-term stay for the executive who returned to the entertainment company last November.

Iger, who led Disney for 15 years as CEO, lasted just 33 months before his handpicked successor, Bob Chabeck.

He is tasked with finding a new successor before he leaves at the end of 2024, but Disney said Wednesday its board voted unanimously to extend Iker’s tenure by two years.

The US is considering sending long-range missiles to Ukraine

President Joe Biden said Wednesday that the United States is considering sending long-range missiles to Ukraine after France and Britain sent similar systems, a significant shift that could alter Washington’s risk calculus in Ukraine as the war drags on.

Kiev has long sought weapons to better penetrate Russian defenses, but Washington has refrained from fearing Russian expansion. France announced this week that it would deploy such weapons and the UK has already deployed its Storm Shadow missiles.

“They already have the equivalent of ATACMS. What we need most of all are artillery shells,” said Biden, who used the name for US long-range missiles as he boarded a plane from Vilnius where he was attending a NATO summit in Helsinki.

Biden says US ‘unwavering’ on Ukraine support

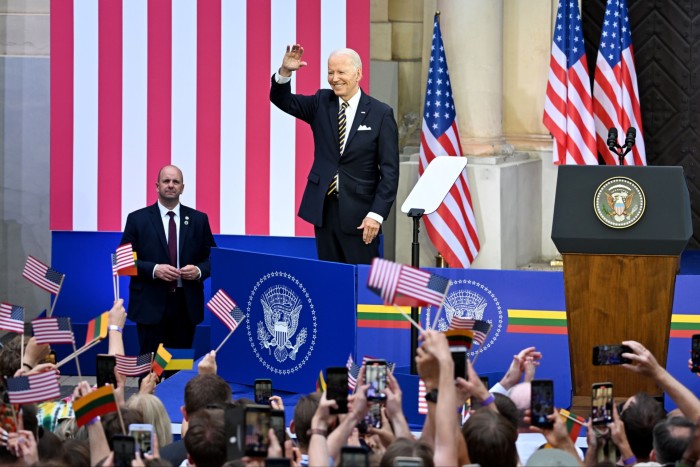

At the end of a wide-ranging speech that wrapped up his visit to Lithuania for a NATO summit, President Joe Biden reaffirmed America’s commitment to supporting Ukraine for the long term.

“We will not budge, we will not waver,” he said. “Let me tell you that. Our commitment to Ukraine will not weaken. We will stand for freedom and liberty today, tomorrow and as long as it takes.

BASF lowers full-year outlook on demand slowdown

German chemical maker BASF on Wednesday cut its full-year outlook, forecasting a slowdown in global consumer demand that is expected to weaken sales and earnings more than previously expected.

The world’s largest chemical maker now expects sales of between €73bn and €76bn, down from an earlier estimate of €84bn-€87bn. Adjusted revenue is forecast at €4bn-€4.4bn, compared with previous estimates of €4.8bn-€5.4bn.

BASF reported its initial second-quarter sales were lower in the quarter than a year earlier. Adjusted revenue was down 57 percent from last year.

“Friend of animals everywhere. Devoted analyst. Total alcohol scholar. Infuriatingly humble food trailblazer.”